SAN FRANCISCO, Calif. – March 27, 2023 –– Augmedix (Nasdaq: AUGX), a leading provider of ambient medical documentation and data solutions delivered remotely to healthcare systems, physician practices, hospitals, and telemedicine practitioners, today reported financial results for the three and 12 months ended December 31, 2022.

“We finished 2022 with our best-ever fourth quarter in terms of bookings, with sales momentum continuing into 2023 with record first-quarter bookings, including our largest-ever clinician cohort signed,” said Manny Krakaris, Chief Executive Officer at Augmedix. “Our expanding portfolio of products has positioned us well for the large market opportunity in front of us, and we look forward to delivering strong results in 2023 with improving operating leverage.”

Continued Krakaris, “Our innovative technology is engineered to relieve the documentation burden for clinicians, allows the patient and doctor to truly connect at the point of care, and structures the visit data that ultimately improves future outcomes for patients and healthcare providers. We operate at the nexus of the critical issues impacting large health systems and U.S. healthcare overall, which are patient access, patient outcomes, and the cost curve. Helping health systems solve these big issues is leading to larger engagements and increased interest from both existing and new systems, as shown by our recent wins. Our development efforts are focused on delivering innovative products that can affect behavior at the point of care to drive better outcomes at scale so that we make a meaningful impact on the industry.”

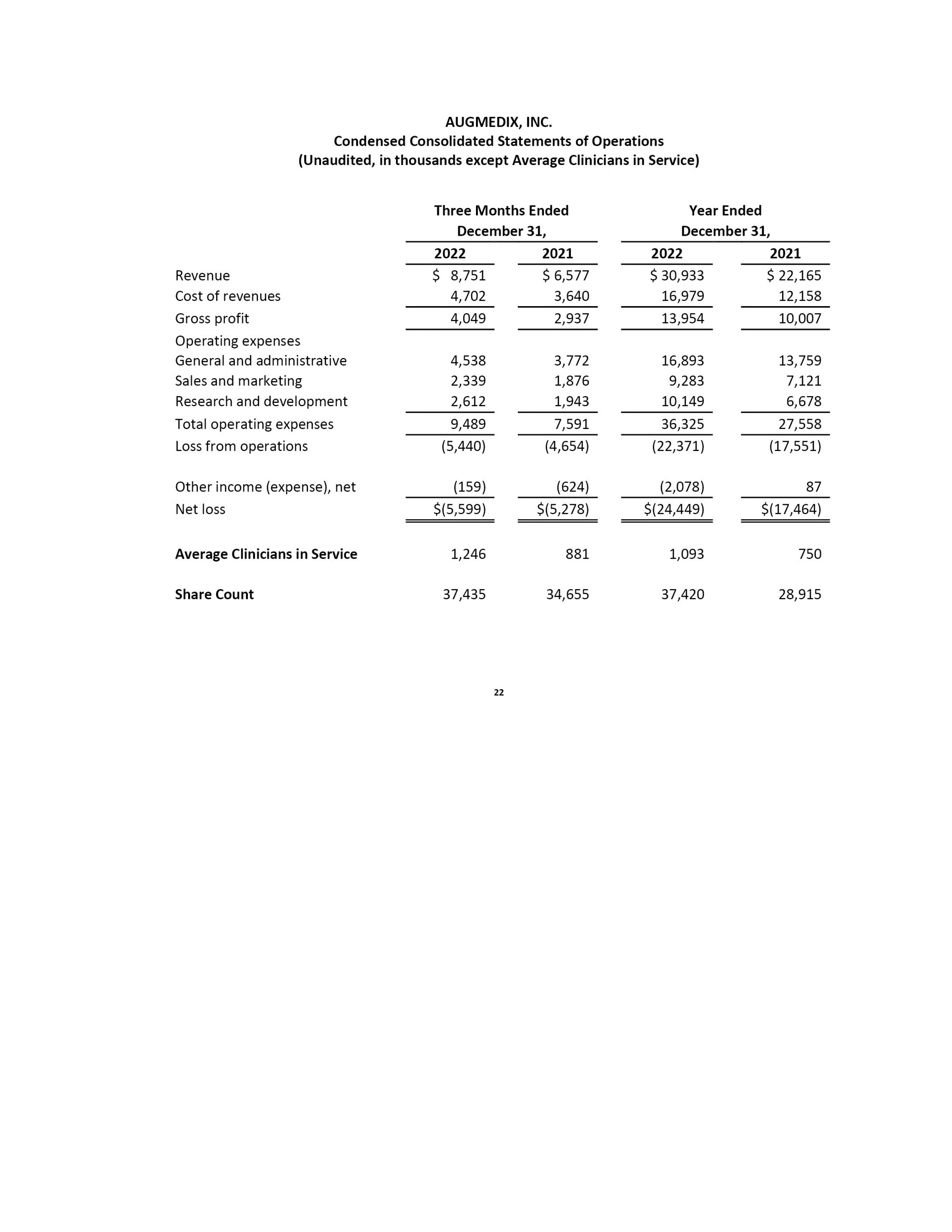

Fourth Quarter 2022 Financial and Operational Highlights

All comparisons, unless otherwise noted, are to the three months ended December 31, 2021.

- Augmedix added one new region of an existing health enterprise with a large cohort of new clinicians in the fourth quarter of 2022, had two major expansions at existing clients, and expanded services with a top 10 health system that was initially won in early 2022.

- We are testing Augmedix Go with a number of clinicians, including several at a large health system.

- We are now integrated with a select number of EHRs, including an EPIC integration with a major health system.

- Total revenue was $8.8 million, slightly stronger than our January pre-announcement and an increase of 33% compared to $6.6 million.

- Dollar-based Net Revenue Retention was 126% for our Health Enterprise customers compared to 136%.

- GAAP Gross Profit increased 38% to $4.0 million from $2.9 million.

- GAAP Gross Margin increased 160 basis points to 46.3% compared to 44.7%, and increased 60 basis points from 45.7% reported in the third quarter of 2022.

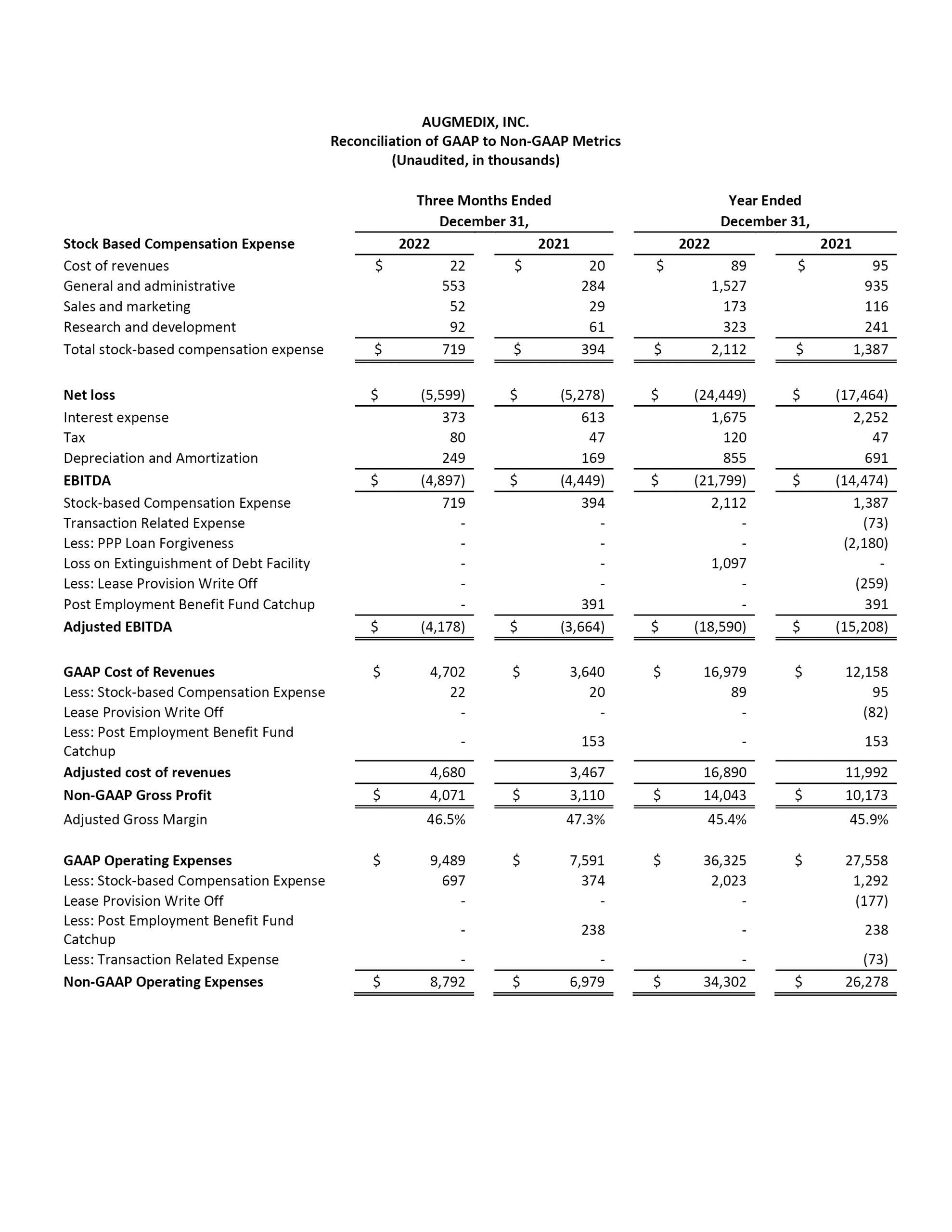

- GAAP Operating Expenses increased 25% to $9.5 million compared to $7.6 million. Adjusted operating expenses, which excludes stock-based compensation and one-time items in both periods, grew 26% to $8.8 million compared to $7.0 million.

- GAAP Net Loss was $5.6 million compared to $5.3 million.

- EBITDA loss was $4.9 million compared to $4.4 million. Adjusted EBITDA loss was $4.2 million compared to $3.7 million, which excludes stock-based compensation in both periods and one-time transaction costs, and a compensation accrual catch-up. Adjusted EBITDA loss again declined sequentially from the $4.5 million reported in the third quarter of 2022 and the $5.3 million reported in the second quarter of 2022.

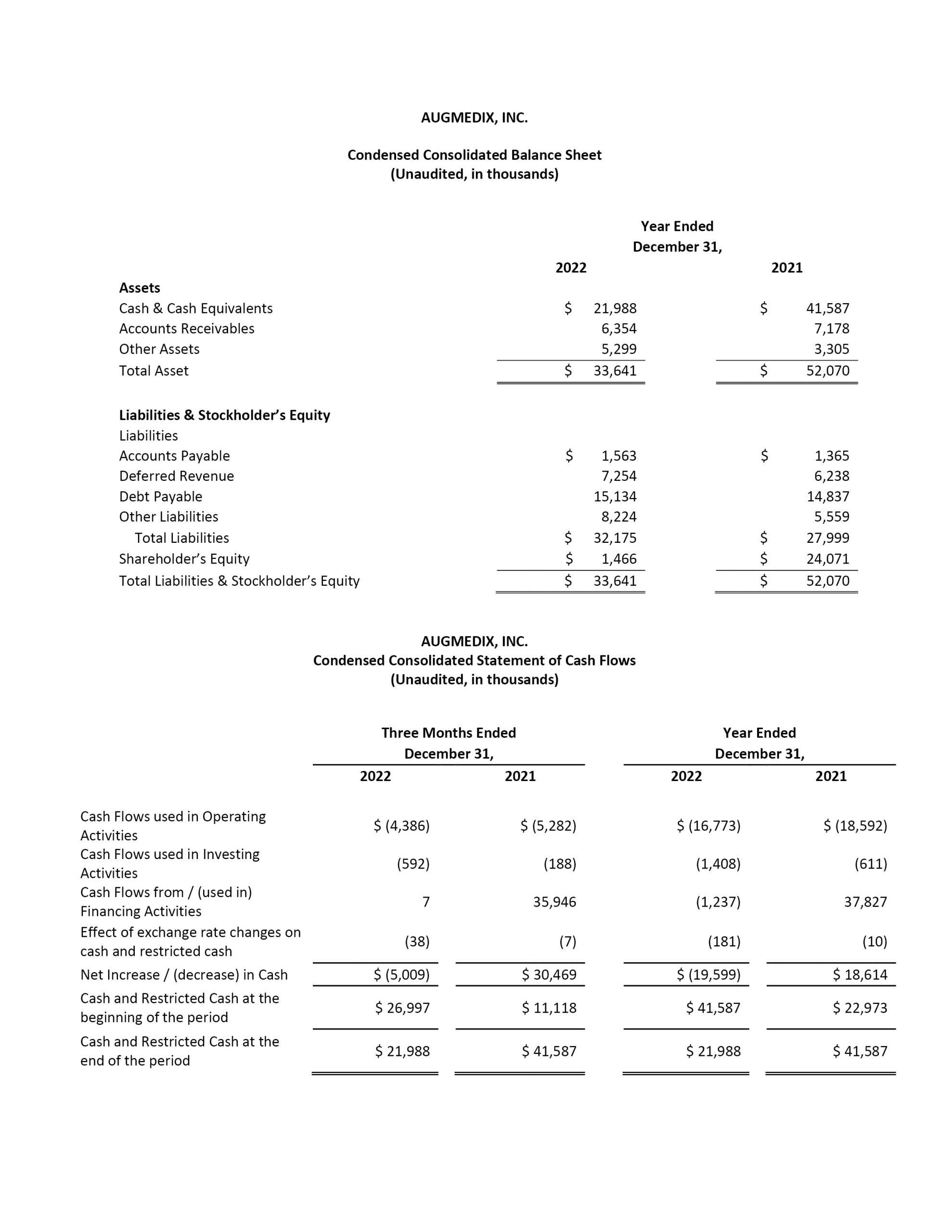

- Cash and restricted cash as of December 31, 2022, was $22.0 million compared to $41.6 million as of December 31, 2021.

Full Year 2022 Financial and Operational Highlights

All comparisons, unless otherwise noted, are to the 12 months ended December 31, 2021.

- Total revenue was $30.9 million, an increase of 40% compared to $22.2 million.

- Dollar-based Net Revenue Retention was 128% for our Health Enterprise customers compared to 124%.

- GAAP Gross Profit increased 39% to $14.0 million from $10.0 million.

- GAAP Gross Margin was flat at 45.1% compared to 45.1% as increased exposure to U.S.-serviced clinicians, who have the highest cost of revenue, offset efficiency gains elsewhere.

- GAAP Operating Expenses were $36.3 million compared to $27.6 million. Adjusted operating expenses, which excludes stock-based compensation and one-time items in both periods, grew 31% to $34.3 million compared to $26.3 million.

- GAAP Net Loss was $24.4 million compared to $17.5 million.

- EBITDA loss was $21.8 million compared to $14.5 million. Adjusted EBITDA loss, which excludes stock-based compensation in both periods and one-time items such as transaction related expenses, the compensation accrual catch-up, PPP loan forgiveness and loss on extinguishment of our prior debt facility, increased to $18.6 million from $15.2 million.

Adjusted gross margin, Adjusted operating expenses, EBITDA and Adjusted EBITDA are Non-GAAP financial measures. See “Non-GAAP Financial Measures.”

2023 Revenue Guidance

Based on the strong finish to 2022 and the momentum that has continued into the first quarter of 2023, Augmedix expects to generate approximately $42 million of revenue in 2023.

Conference Call

Augmedix will host a conference call at 5:00 a.m. PT / 8:00 a.m. ET today, Monday, March 27, 2022, to discuss its fourth quarter and full year 2022 financial results. The conference call can be accessed by dialing + 1-877-407-3982 for U.S. participants or +1 (201) 493-6780 for international participants and referencing conference ID # 13726968. Interested parties may access a live and archived webcast of the event on the “Investor Relations” section of the Company’s website at: ir.augmedix.com.

Definition of Key Metrics

Dollar-Based Net Revenue Retention: We define a “Health Enterprise” as a company or network of doctors that has at least 50 clinicians currently employed or affiliated that could utilize our services. Dollar-based net revenue retention is determined as the revenue from Health Enterprises as of twelve months prior to such period end as compared to revenue from these same Health Enterprises as of the current period end, or current period revenue. Current period revenue includes any expansion or new products and is net of contraction or churn over the trailing twelve months but excludes revenue from new Health Enterprises in the current period. We believe growth in dollar-based net revenue retention is a key indicator of the performance of our business as it demonstrates our ability to increase revenue across our existing customer base through expansion of users and products, as well as our ability to retain existing customers.

Average Clinicians in Service: We define a clinician in service as an individual doctor, nurse practitioner or other healthcare professional using our products. We average the month-end number of clinicians in service for all months in the measurement period and the number of clinicians in service at the end of the month immediately preceding the measurement period. We believe growth in the average number of clinicians in service is a key indicator of the performance of our business as it demonstrates our ability to penetrate the market and grow our business.

About Augmedix

Augmedix is on a mission to help clinicians and patients form a human connection at the point of care with seamless technology. Augmedix’s proprietary Notebuilder Platform extracts relevant data from natural clinician-patient conversations and converts that data into medical notes in real time, which are seamlessly transferred to the EHR. The company’s platform uses Automatic Speech Recognition, Natural Language Processing, including Large Language Models, and Medical Documentation Specialists to generate accurate and timely medical notes to healthcare providers. Leveraging this platform, Augmedix’s products relieve clinicians of administrative burden, in turn, reducing burnout and increasing both clinician and patient satisfaction. Augmedix is also leading the revolution in leveraging point-of-care data by making connections between millions of physician-patient interactions and analyzing them to deliver actionable insights that elevate patient care. Augmedix is headquartered in San Francisco, CA, with offices around the world. To learn more, visit www.augmedix.com.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: adjusted cost of revenue, adjusted gross profit, adjusted gross margin, adjusted operating expenses, EBITDA, and adjusted EBITDA. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our recurring core business operating results, like one-time transaction costs related to the reverse merger and OTC listing. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business.

There are a number of limitations related to the use of non-GAAP financial measures. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures and evaluating these non-GAAP financial measures together with their relevant financial measures in accordance with GAAP.

Forward-Looking Statements

This press release contains “forward-looking statements” that involve a number of risks and uncertainties. Words such as “believes,” “may,” “will,” “estimates,” “potential,” “continues,” “anticipates,” “intends,” “expects,” “could,” “would,” “projects,” “plans,” “targets,” and variations of such words and similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, without limitation, statements regarding sales momentum continuing into 2023 with record first-quarter bookings; our expanding portfolio of products positioning us well for the large market opportunity in front of us; our looking forward to delivering strong results in 2023 with improving operating leverage; our helping of health systems leading to larger engagements and increased interest from both existing and new systems; our development efforts focused on delivering innovative products so that we make a meaningful impact on the industry; the momentum that has continued into the first quarter of 2023; and our expectation to generate approximately $42 million of revenue in 2023. Forward-looking statements are based on management’s expectations as of the date of this filing and are subject to a number of risks, uncertainties and assumptions, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in our most recent Form 10-K filed with the Securities and Exchange Commission on March 30, 2022 as well as other documents that may be filed by us from time to time with the Securities and Exchange Commission. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: our expectations regarding changes in regulatory requirements; our ability to interoperate with the electronic health record systems of our customers; our reliance on vendors; our ability to attract and retain key personnel; the competition to attract and retain remote documentation specialists; anticipated trends, growth rates, and challenges in our business and in the markets in which we operate; our ability to further penetrate our existing customer base; our ability to protect and enforce our intellectual property protection and the scope and duration of such protection; developments and projections relating to our competitors and our industry, including competing dictation software providers, third-party, non-real time medical note generators and real time medical note documentation services; the impact of current and future laws and regulations; the impact of the COVID-19 crisis on our business, results of operations and future growth prospects. Past performance is not necessarily indicative of future results. The forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Investors:

Matt Chesler, CFA

FNK IR

investors@augmedix.com

Media:

Kaila Grafeman

Augmedix

pr@augmedix.com